Mathematics | Free Full-Text | Alternative Financial Methods for Improving the Investment in Renewable Energy Companies | HTML

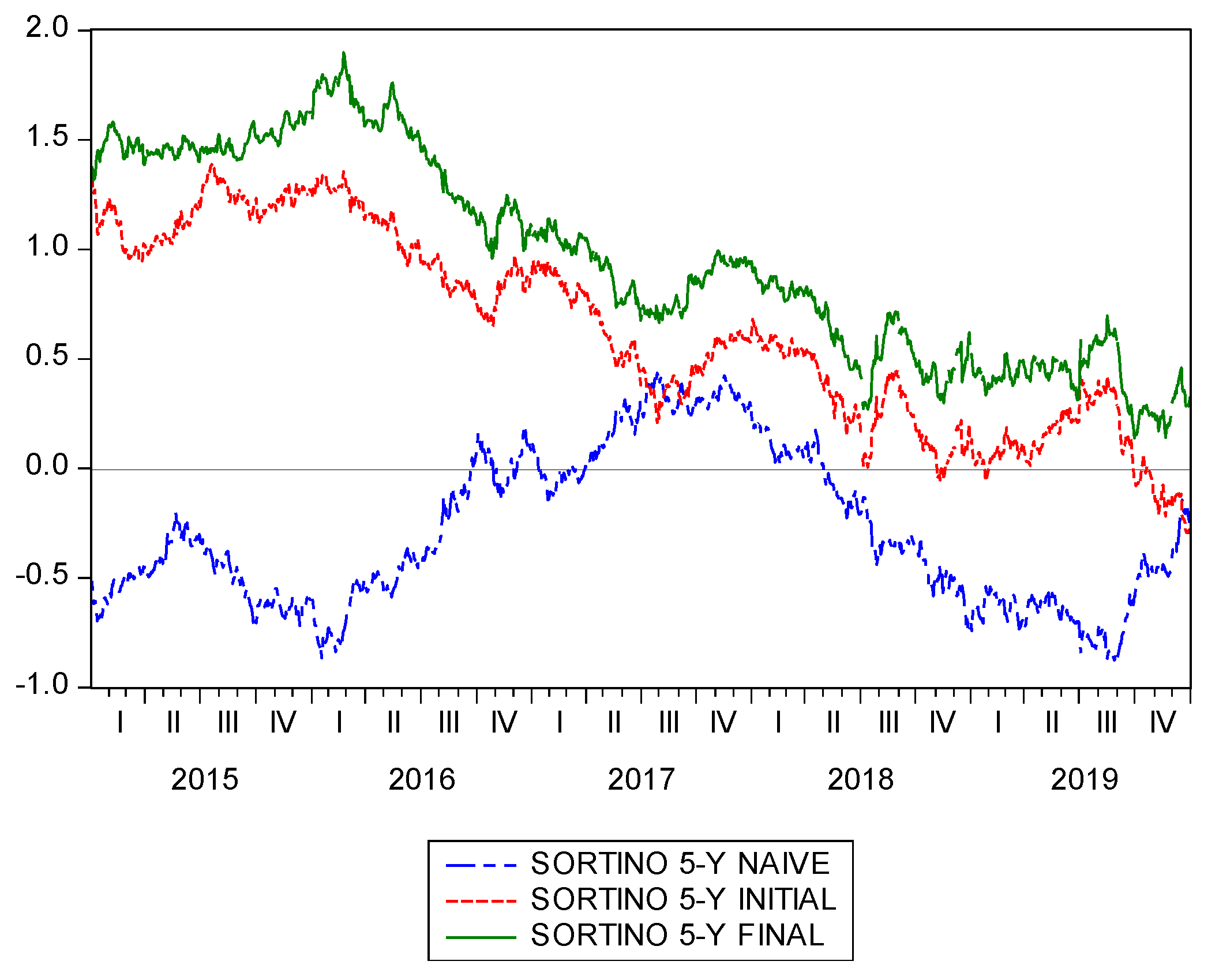

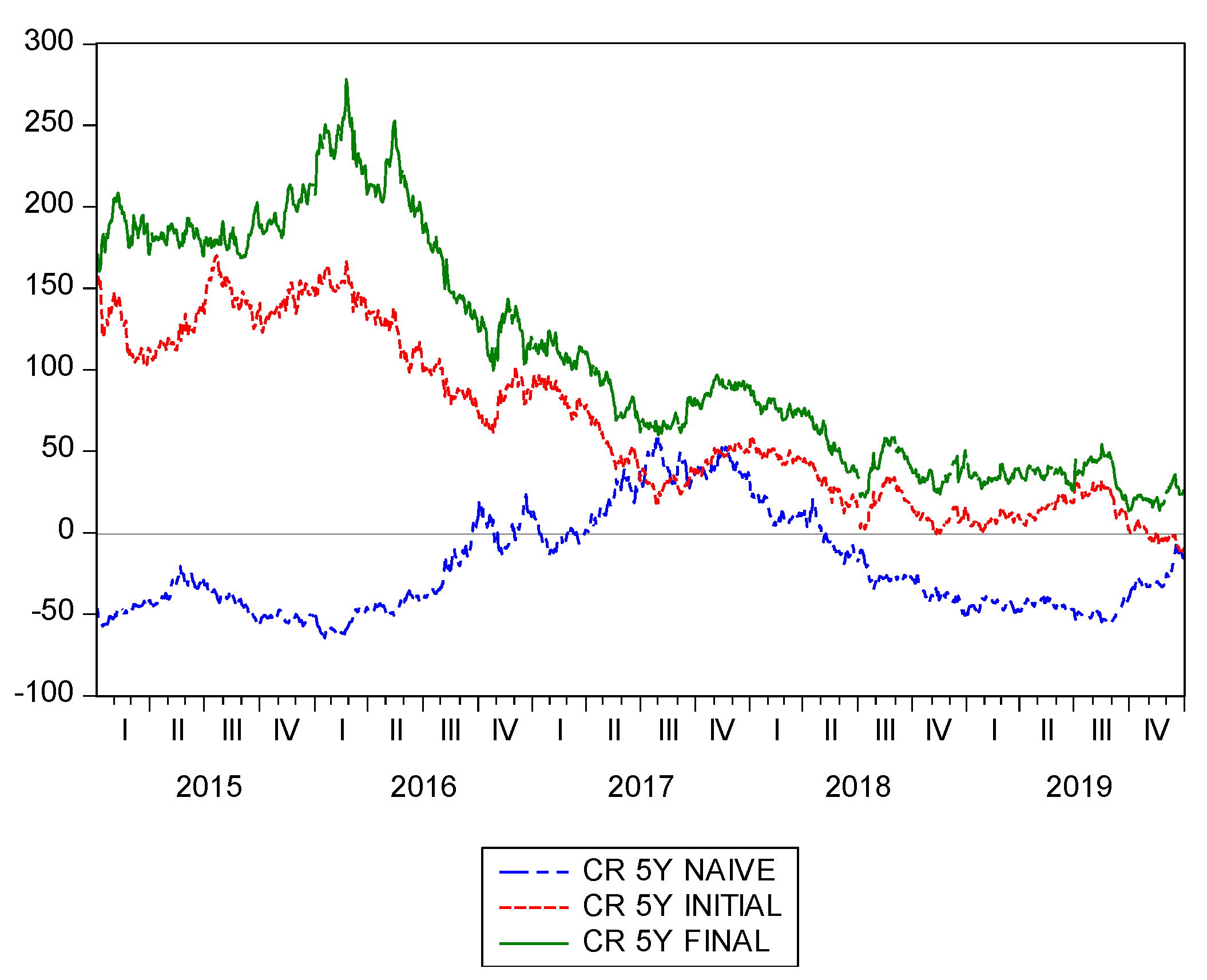

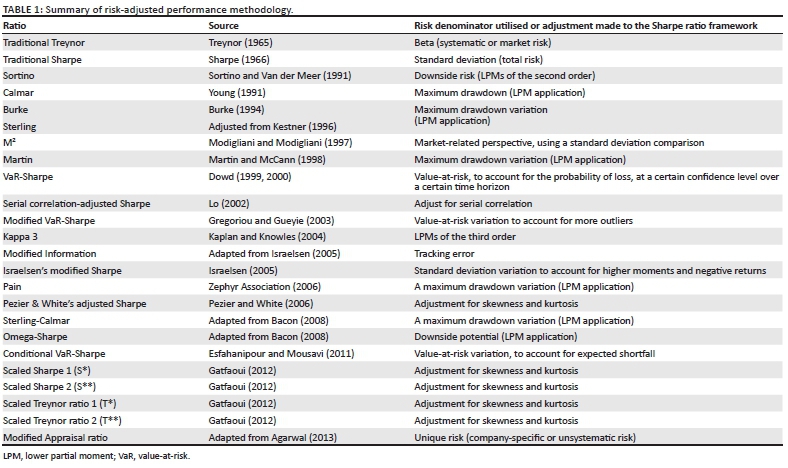

Establishing the risk denominator in a Sharpe ratio framework for share selection from a momentum investment strategy approach

Mathematics | Free Full-Text | Alternative Financial Methods for Improving the Investment in Renewable Energy Companies | HTML

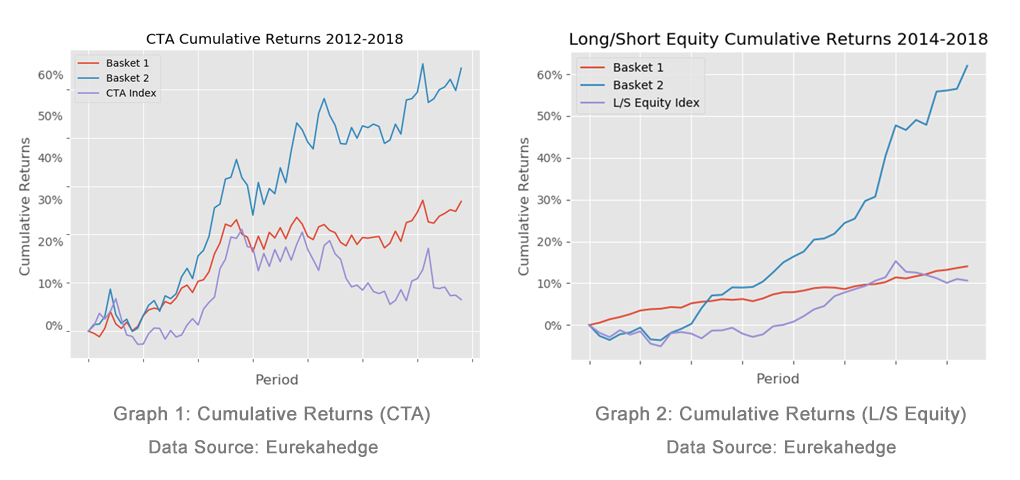

A Dynamic Fuzzy Money Management Approach for Controlling the Intraday Risk‐Adjusted Performance of AI Trading Algorithms - Vella - 2015 - Intelligent Systems in Accounting, Finance and Management - Wiley Online Library

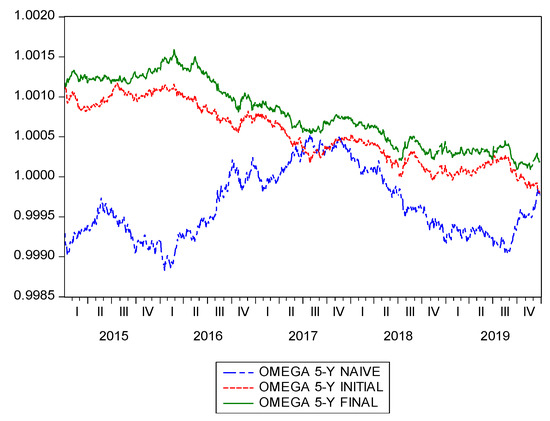

Econometric Modeling to Measure the Efficiency of Sharpe's Ratio with Strong Autocorrelation Portfolios

Mathematics | Free Full-Text | Alternative Financial Methods for Improving the Investment in Renewable Energy Companies | HTML

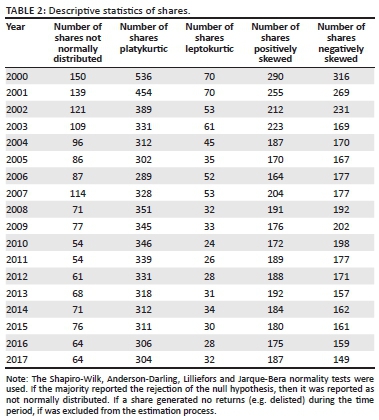

Establishing the risk denominator in a Sharpe ratio framework for share selection from a momentum investment strategy approach

AlternativeSoftFund Selection using Alternative Statisitcs - Best Platform to Select Funds - Best Platform to select Hedge Funds - Best Software Fund Selection - AlternativeSoft

Establishing the risk denominator in a Sharpe ratio framework for share selection from a momentum investment strategy approach

Establishing the risk denominator in a Sharpe ratio framework for share selection from a momentum investment strategy approach

PDF) Establishing the risk denominator in a Sharpe ratio framework for share selection from a momentum investment strategy approach